Wills, Trusts & Powers of Attorney

- Wills

- Domestic Wills

- International Wills

- Primary/Secondary Wills

- Continuing Powers of Attorney

- Health Care Directives

- Spousal Trusts

- Henson Trusts

- Minor Trusts

- Life Insurance Trusts

- Alter Ego Trusts

- Professional Trustees/Executors

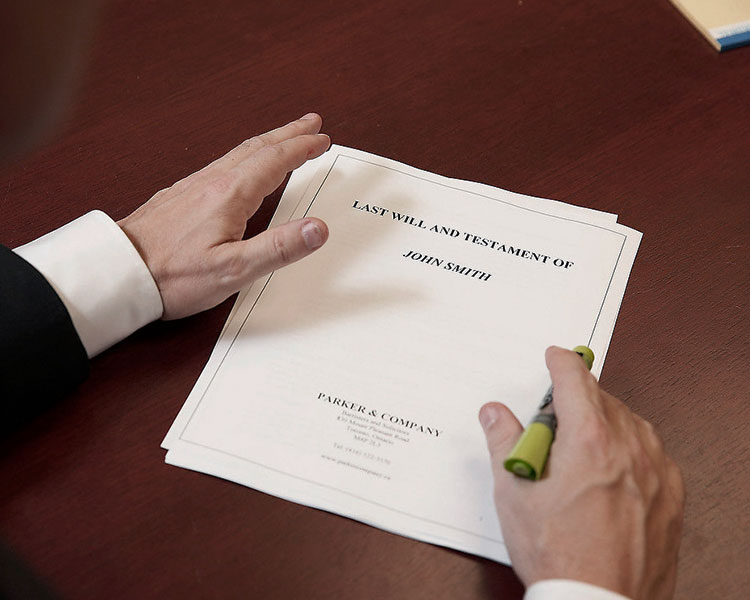

Parker & Company has extensive experience in the planning of and preparation of Wills, Powers of Attorney and various Trusts. We assist clients with a range of Estate Planning needs, including the preparation of Primary and Secondary Wills and establishing and varying various Trusts (i.e. Testamentary Trusts, Spousal Trusts, Minor’s Trusts and Trusts for Disabled Beneficiaries).

With our assistance, Clients strive to plan and see their wishes carried out. We ensure our Client’s life planning is in place with trusted Attorneys (i.e. Substitute Decision Makers) and that their estate planning directions are carried out through their appointed Estate Trustees, while maximizing their wealth transfer and minimizing Income Tax and Estate Administration Tax (i.e. Probate Tax).

If you fail to appoint an Attorney for Property and you are found to be incapable of managing your property, a Guardianship Application will be necessary, just for your bills to be paid. What will happen in the meantime? If you die without a Will – Intestate – the law in Ontario will determine the distribution of your property. Preparing a plan, Powers of Attorney and Wills should not be left until late in life. Steps should be taken and your life and estate plans updated from time to time in order to ensure that you and those you love and care for most will be properly taken care of and not left with a crisis.

If you would like to discuss the benefits of life and estate planning – Wills, Powers of Attorney and/or Trusts – or if you would like our free Life & Estate Planning Worksheet, we encourage you to contact us at (416) 322-3370 extension 230 to arrange for a consultation or to have our Worksheet sent to you.

Recent Engagements

Mr. Parker met with the Client, reviewed his circumstances including the nature of his businesses, took instructions and prepared Multiple Wills. His Secondary Will addressed his Secondary Estate, which addressed various corporations and personal property, as well as options to purchase his corporations and a spousal trust.

Ms. Hodgson met with her Client at her assisted living residence, took instructions on changes to her Will and attended to its execution. She also addressed the sale of her residence, documented her instructions and prepared an agreement between herself and her attorney by way of Power of Attorney.

Ms. Kofman, along with Mr. Parker, met with the Client at her home. The Client no longer desired to have her Attorney for Property continue. She wanted to remain in her home for the rest of her life and was concerned that her Attorney might be misusing her monies and/or cause her to move to a long term care residence if she was found incapable of making certain decisions. Ms. Kofman and Mr. Parker took instructions and prepared, on the spot, a Revocation of the Continuing Power of Attorney for Property and a Statement of Wishes, to ensure her continued residence at home.

You're Invited to Call or Email Today

Parker & Company

Barristers & Solicitors

830 Mount Pleasant Road

Toronto, Ontario M4P 2L3

Tel: (416) 322-3370

Fax: (416) 322-7153